Dealing with money

Reading Length: Mid read – 5 mins

What is it?

One of the top things everyone always says they wished they got taught at school was… money! So, let’s talk about it. Money can be a hard conversation for a lot of people. However, everyone is affected by money, so let’s start having healthy conversations about how to save and spend our money!

It’s also important to remember learning and facing money is a skill set in itself, so don’t panic if you don’t get it perfect the first-time round. You’ve got plenty of time to learn what works best for you when dealing with your money.

Ways to save money

Whether you’re planning on saving up £10 or £100, putting money aside is an achievement you should feel proud of.

Here’s some helpful tips to help you save some money.

Start a savings account – By regularly seeing what is going in and out of your bank account, you will be able to see a bit clearer what you can cut back on.

Little and often – If trying to collect big chunks of money together seems impossible. Try saving £1 a day. By the end of the year, you will have nearly £400 to your name!

Be realistic – Making unrealistic goals can make you feel 10 times worse and give you more of a reason to chuck the target in the bin.

Give yourself an allowance – “I will only spend £20 pound this weekend when I go into town”

Don’t be hard on yourself if you mess up – Everyone is guilty of impulsive purchases! The important thing is to stay motivated and pick up where you left off.

Enjoy yourself – When you have hopefully reached that goal, enjoy it!

Ways to earn money

I guess there’s no point in us explaining how you should save money if you don’t know how to actually get the money in the first place. So, here’s some accessible ways you can make a bit of money on the side.

Paid Jobs – If you have some spare time at the weekends, this can be a great way to earn money consistently over time. Great jobs to start off with to gain work experience can include, delivering newspapers, dog walking, babysitting, washing cars and much more. Here are a few sites to look at when finding local jobs: Indeed, Linkedin, UK Gov, Not going to Uni (Apprenticeships/work experience) or your local Facebook job pages.

It’s important to note, when looking for jobs, it can feel tedious at times and can leave us feeling disheartened. Perhaps, set yourself the task of applying for 10 jobs with a deadline in mind and then give yourself a break for the hard work you’ve already put in. Applying for jobs is half the battle, so give yourself a pat on the back for getting this far!

Selling old possessions – Thanks to the power of the internet, there are some great platforms (eBay, Depop, Vinted, Gumtree) available where you can sell second-hand items such as clothes, toys, DVDs, books etc. *some of these platforms are for above 18-year old’s only, so ask a responsible adult to post your items on your behalf*.

YouGov – If you are over 16, you can sign up to YouGov, a UK-based market research firm that will pay you to answer questionnaires.

Young Enterprise – click here to find out your local Young Enterprise programmes in Manchester where you can learn the essentials of running a business, in an education setting, while making money!

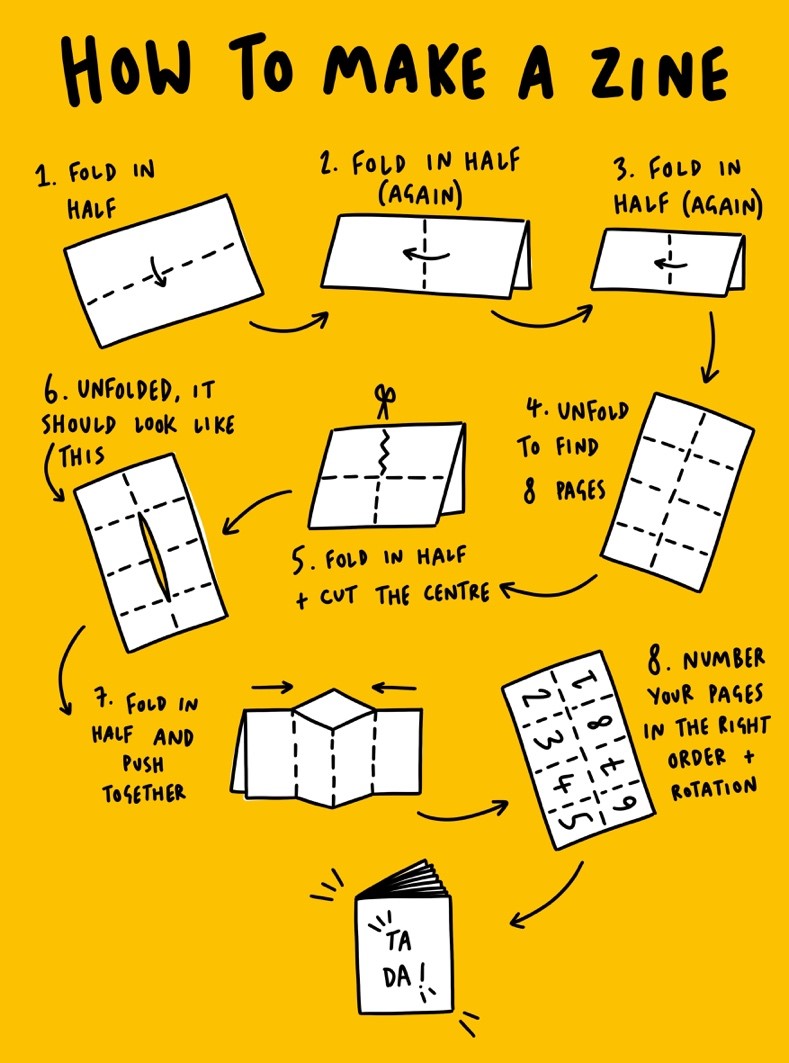

Get creative - If you’re talented in something, use that to your advantage – If you’re known among your family and friends that you’re great at drawing pets, why not try and sell some illustrations that they can take home and frame? Or if you and some pals collectively want to combine your skills, this is a great way to make money while having fun.

Here are a few ways you can sell homemade items: market places (Makers Market , Manchester Art Fair, Chorlton Art Maket), Etsy (click here to read ‘How to Open an Etsy Shop’), Depop/Ebay (click here to read how to sell crafts on online platforms).

Financial stress and debt

If you are struggling with managing your money or have debt, it can be hard to know where to turn and can feel overwhelming. Luckily, there are lots of charities and organisations available to offer non-judgmental and confidential support.

“Most people who seek debt advice feel less stressed or anxious and more in control of their life” (source: Prince’s Trust).

Here are a few organisations who offer support and solutions for your debt.

Debt Advice Service – help you find solutions to your debt or financial issues

Step Change – offer free debt advice

Prince’s Trust – offer budget planners and other free resources to help you budget

National Debt Line – offer resources and advice to help you manage your debts and budget

Pay Plan – offer advice to help manage your debt

Where to go for more support

If you feel money is a leading factor in causing you stress and anxiety, it might be a good idea to talk to someone. If you feel this is the case, you can chat to someone online via text, you can register for ongoing online support via our online support portal. We also hold weekly drop-in sessions so that you can speak with a worker without an appointment.

We provide a number of face-to-face services too, all of which offer something slightly different depending on what’s best for you. Overall, though, every service provides you with someone who will listen, acknowledge your feelings, and work with you to help find resolutions. You can read about our services here.

By: Daisy Wakefield